Retirement Planning Services

Education Planning Services

Estate Planning

Business Continuation

Risk Management Planning

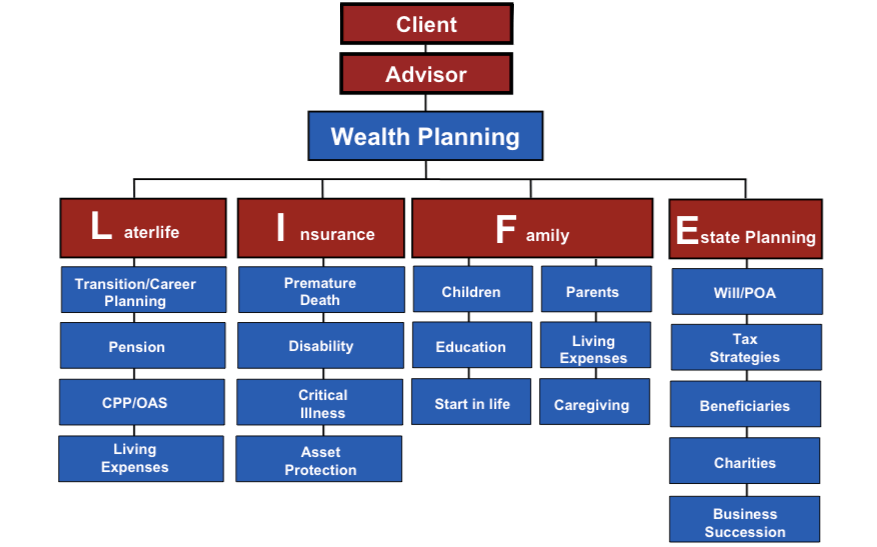

At Hartry Foley Financial, we offer a broad range of financial services. We are an independent financial services company that offers financial recommendations and service to individuals, families, and business. Our strengths are financial wealth planning & estate planning. We specialize in asset protection.

Retirement Planning Services

We help individuals find the appropriate solutions to retirement, through detailed discussion of their goals and needs; both financial and personal. These retirement goals are then managed with independent investing into actively managed portfolios. These portfolios are designed to provide income, tax efficiency, potential principal growth, estate protection of our clients assets. Click here to learn more about our Retirement Planning Services

Education Planning Services

As education skyrockets, education planning has become an integral part of the financial planning process. Whether it is an education program for your children, other family members, or grandchildren, education savings are a must. The development of government programs involving grants have helped families save for their children’s futures. Hartry Foley Financial provides its clients with the information necessary to devise the best plan of action. Click here to learn more about our Education Planning Services.

Estate Planning

Many Canadians think of Estate planning as only a will. There is much more to consider. Hartry Foley Financial has a successful history of helping individuals with their estate planning needs. Many clients wish to direct their monies toward specific beneficiaries, and most wish to avoid paying the CRA anything… An Estate plan will effectively decrease the amount of tax payable, and will also provide the peace of mind that the estate distribution goals will be met. Click here to learn more about our Estate Planning Services.

Business Continuation Planning

What would happen to your business? What would happen to your life, as you know it? All business owners need to have a program in place that would continue payments to banks , suppliers and services to their customers. Click here to learn more about our Business Continuation Planning Services.

Risk Management Planning

As we age, we face many obstacles. We need to protect our assets and our lifestyles from these obstacles. What happens to our families if we die, if we get disabled, if we get sick or if we live too long? These are all the risks that each of us face. Through proactive planning, these risks can be minimized or eliminated. Click here to learn more about our Risk Management Planning Services.